INTRODUCTION

Tea is one of the ancient and non-alcoholic beverages made

steeping the leaves of Camellia Sinensis used throughout the world because of

its taste, aroma and health benefits. There are different types of tea across

the globe like Black tea, Green Tea, Yellow, Oolong and White tea etc., in

which black tea is more than 75% of all tea produced in the world and 20% is green tea.

Tea has many antioxidants like polyphenols (theaflavins,

thearubigins and catechins) that can help prevent several chronic diseases

including cancer. There are a wide range of tea available in the market across

the globe, but some of black tea hail from the Indian regions like Assam,

Darjeeling and Kangra. There are numerous scientific evidence showing that

black tea can make significant contribution to a healthy lifestyle, and in the

area of chronic diseases including cardiovascular health and dental hygiene.

Production Highlights

India is the 2nd largest producer of tea in the

world after China, including the famous Assam tea and Darjeeling tea. In 2018,

Global tea production was 5896.65 M Kgs (Million Kilograms) in which India’s

share was 22.70 % (approx. 1338.63 M Kgs).

In India, Assam is leading tea producing state followed by

West Bengal, Tamil Nadu, Kerala, Tripura, Arunachal Pradesh and Himachal

Pradesh.

Among the ASEAN countries, Vietnam and Indonesia are major

tea producing countries with Malaysia and Myanmar contributing very small to

the production. In total global tea production Indonesia (131 M Kgs) &

Vietnam (163 M Kgs) are ranked 5th and 6th respectively. Indonesia

contributes only 3% share of the global tea market.

Generally, cost of production and rising prices has led

tea farmers to switch to higher production of crops such as rubber, palm oil

and vegetables. In recent years, tea production in Indonesia has decreased from

146.68 M Kgs in 2014 to 139.36 M Kgs in 2018.

Major Tea Exporters

Major Tea Exporters

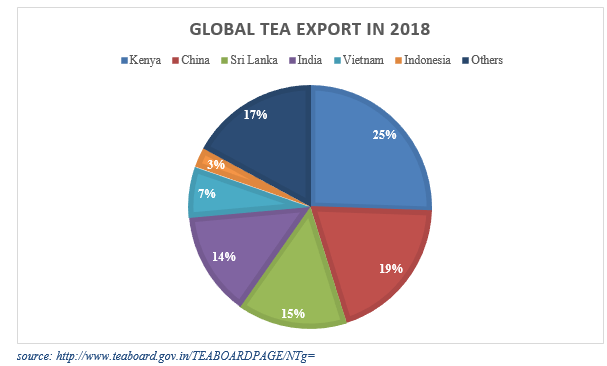

India is the 4th largest exporter of tea led by Kenya,

China & Sri Lanka. In 2018, total global tea export was 1858.82 M Kgs in

which India’s share was 13.77% (256.6.06 M Kgs).

In ASEAN countries, Vietnam and Indonesia are major

exporter of tea, globally ranked 5th & 6th respectively. ASEAN countries

except Vietnam & Indonesia do not produce tea and they mostly import it

from neighboring countries. That is why India has great opportunities to expand

their tea exports in ASEAN countries.

Drivers for Increasing Demand

Drivers for Increasing Demand

All the ASEAN countries (Malaysia, Myanmar, the

Philippines, Singapore, Thailand, and Vietnam etc.) are tea-drinking nations,

but except few, the other countries do not produce the beverage and hence there

is enormous potential of exporting tea to these countries.

In Singapore and neighboring countries, people consider tea

as a healthier option to coffee. Singapore’s consumer market is driven by young

people which has a great interest in specialty teas, regardless of the health

benefits of drinking it. Singapore and nearby nations are adopting a global industry

trend that combines tea into other aspects of daily lifestyle such as cocktails

or cuisines. Many eateries in these countries are already cooking with tea and

cafes or restaurants have modified their menus to serve to tea lovers.

Black tea consumption in ASEAN countries is expected to

grow by 2% according to the world report on the tea outlook for 2027. Vietnam

is ranked 7th & Indonesia is ranked 13th in a slot of global

import of tea. So, there is an immense opportunity for India to target ASEAN markets.

REFERENCES

Ø https://www.aseanbriefing.com/news/investing-aseans-tea-industry/

Useful information...thank you Miss Neha Sharma

ReplyDeleteKeep it up

Good one ma'am

ReplyDeleteGood work keep it up 👍👍

ReplyDeleteGood work!

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteKeep it up!

ReplyDelete